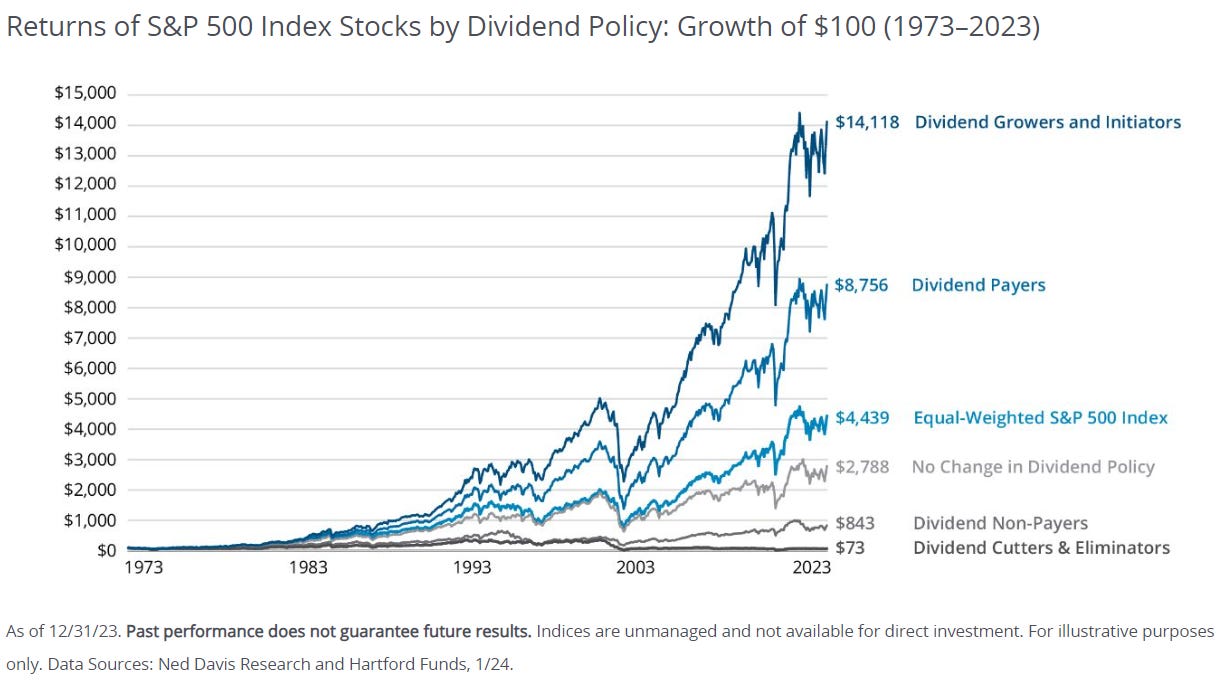

Investing in companies that grow or initiate dividends has historically led to superior returns with reduced volatility.

According to a study by Hartford Funds, since 1973, dividend growth stocks have delivered the highest returns relative to other stocks, while experiencing significantly less volatility.

Source: Hartford Funds

Dividend Cutters & Eliminators are the worst performers and should be avoided. Out of 1004 stocks in de Russell 1000 database, 679 are Dividend Payers, and 588 Dividend Growers & Initiators.

Dividend Growth May Be a Key to Outperformance

Dividend growth stocks provide investors with the potential for a growing income stream. Companies that consistently increase their dividends offer higher income over time, which is particularly valuable during inflationary periods or for those looking to enhance their income.

These companies are typically in good financial health and have business models that generate consistent, reliable cash flow. Regular dividend increases also signal confidence from management in the company's future earnings and financial stability.

The companies on this list have demonstrated their commitment to dividend growth, having initiated or increased their dividends over the past five years, and maintain a payout ratio of no more than 80%.

I started with the 1.000 largest companies in de US (Russell 1000 index). Data provided by QuickFS.

Here are the 10 high yield dividend growers for July 2024 sorted by dividend yield:

Top 10 High Yield Dividend Growers - July 2024

10. Citizens Financial Group Inc

Citizens Financial Group Inc., headquartered in Providence, Rhode Island, is one of the largest retail banks in the United States, offering a broad range of financial services to individuals, small businesses, and large corporations. Citizens operates approximately 1,000 branches and provides banking, lending, wealth management, and investment services across the New England, Mid-Atlantic, and Midwest regions.

9. Evergy Inc.

Evergy Inc. is an electric utility company headquartered in Kansas City, Missouri, serving approximately 1.6 million customers in Kansas and Missouri. Formed in 2018 through the merger of Westar Energy and Great Plains Energy, Evergy focuses on providing reliable, sustainable, and affordable energy solutions, with significant investments in renewable energy and energy efficiency programs (Dividend history).

8. U.S. Bancorp

U.S. Bancorp, headquartered in Minneapolis, Minnesota, is the parent company of U.S. Bank, the fifth-largest commercial bank in the United States. Offering a comprehensive range of financial services including consumer banking, corporate banking, and wealth management, U.S. Bancorp serves millions of customers with a commitment to innovation and community engagement (Dividend history).

7. Amcor PLC

Amcor PLC is a global leader in packaging solutions, providing innovative and sustainable packaging for food, beverage, pharmaceutical, medical, home, and personal care products. Headquartered in Zurich, Switzerland, Amcor operates in over 40 countries, emphasizing environmental responsibility and advanced design to meet the needs of diverse industries.

6. LyondellBasell Industries NV

Industry: Chemicals

Market Cap: $30,471M

Dividend Yield: 5.3%

Dividend Payout Ratio: 76%

5-Year Dividend CAGR: 5.6%

LyondellBasell Industries is a leading global chemical company headquartered in Houston, Texas, and Rotterdam, Netherlands, specializing in the production of plastics, chemicals, and refining technologies. Established in 2007, it is known for its innovative polymer solutions and sustainable practices, serving diverse industries with high-performance materials and advanced recycling capabilities.

5. Franklin Resources Inc

Industry: Capital Markets

Market Cap: $11,621M

Dividend Yield: 5.5%

Dividend Payout Ratio: 70%

5-Year Dividend CAGR: 5.8%

Franklin Resources Inc., commonly known as Franklin Templeton, is a globally renowned investment management firm headquartered in San Mateo, California. Founded in 1947, it offers a wide range of financial products and services, including mutual funds, ETFs, and retirement solutions, managing over $1.5 trillion in assets for individual and institutional clients worldwide.

4. Comerica Inc

Industry: Banks

Market Cap: $6,620M

Dividend Yield: 5.7%

Dividend Payout Ratio: 44%

5-Year Dividend CAGR: 9.1%

Comerica Inc is a financial services company that offers a range of banking products. Known for its strong dividend yield and steady growth, it is a solid choice in the banking sector (Macrotrends).

3. VICI Properties Inc

Industry: Specialized REITs

Market Cap: $28,948M

Dividend Yield: 5.9%

Dividend Payout Ratio: 65%

5-Year Dividend CAGR: 10.4%

VICI Properties Inc specializes in gaming, hospitality, and entertainment properties. Its robust dividend growth and yield make it a strong contender in the REIT sector.

2. Chord Energy Corp

Market Cap: $10,572M

Dividend Yield: 6.1%

Dividend Payout Ratio: 51%

Chord Energy is a U.S. oil producer with a premier Williston Basin acreage position. Chord acquires, exploits, develops, and explores for crude oil, natural gas, and natural gas liquids. Chord started paying dividend in 2021 (see Morningstar).

1. Civitas Resources Inc

Industry: Oil, Gas & Consumable Fuels

Market Cap: $6,769M

Dividend Yield: 10.2%

Dividend Payout Ratio: 66%

Civitas Resources Inc is engaged in the exploration and production of oil and gas. It boasts the highest dividend yield on the list. The company is a dividend initiator (see Morningstar). Most analysts offer a Buy recommendation (Yahoo).

These companies show consistent dividend growth, making them attractive options for income-seeking investors.