A 5-Step Investment Process to Improve Performance

Approach tailored to guide you through the complexities of stock selection

Greetings, fellow investors!

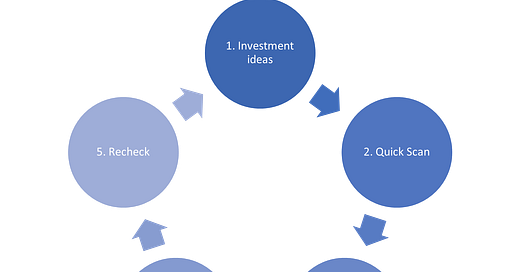

In this edition, we delve into an effective 5-step investment process designed to help you limit risks and enhance your portfolio's performance. The fundamental idea is buying assets below their value. Inspired by the timeless wisdom of legendary investors like Warren Buffett, Monish Prabai, and Peter Lynch, this methodical approach is tailored to guide you through the complexities of stock selection and management. Let's explore how you can transform thousands of potential stock picks into a refined, high-potential portfolio.

1. Generating Investment Ideas

The journey to a successful investment begins with robust idea generation. Using models and algorithms based on proven strategies from top investors, I search thousands of stocks to identify promising candidates.

By incorporating the investment philosophies of icons like Peter Lynch, who emphasizes understanding what you own, and Warren Buffett, who advocates for value investing, we create a solid foundation for finding mispriced stocks. These models help us pinpoint opportunities where the market may have overlooked or undervalued certain companies, setting the stage for potential gains.

It’s like cloning the greatest investors. Warren Buffett focuses on excellent companies with growing earnings for a reasonable price. Berkshire for example first bought Apple stocks in the first quarter of 2016. When the price of an Apple stock was $ 25 with a price-to-earnings ratio (P/E) of 11. Now Apple is trading at $ 214 with a P/E 33. We are not looking for the best companies, but the best investment opportunities.

In the next newsletter, I will share the Top 10 Cheap Growth Stocks inspired by legendary investor John Neff. He managed the Windsor Fund at Vanguard for over three decades, achieving an impressive annual return of 13.7 %, compared to the index's 10.7% investing in low price-to-earnings growth stocks.

2. Conducting a Quick Scan

Once we have a list of potential stocks, the next step is a quick scan to assess their viability. This involves answering critical questions like, Do you understand the company? It's crucial to have a clear grasp of the company's business model, products, and market position. If you can't explain how the company makes money in simple terms, it might be best to pass.

Are there positive expectations for the future? Look for companies with promising growth prospects, innovative strategies, and a strong competitive edge. Positive future expectations can be a strong indicator of potential success. With cyclical companies you look for recovery prospects.

I don’t like companies who have too much debt or when current earnings seem an one-off. Or does it fit in your portfolio.

This quick scan helps to eliminate companies that don't meet your basic criteria, allowing you to focus on more promising opportunities.

3. Performing Fundamental Analysis and Valuation

After narrowing down the list, it's time to dive deeper with fundamental analysis and valuation. This step is about determining whether a stock is cheap or expensive relative to its intrinsic value. This is the hardest part and most time consuming. Key aspects to evaluate include:

Financial Health

Examine the company's balance sheet to assess its financial stability and strength. Is a company able to pay its bills on the short (liquid) and long term (solvent)? Is there enough cash to keep operations going or survive a recession? These kind of questions are answered to check the financial health of a company.

Growth

Growth is a vital component when assessing a company's future potential. When evaluating growth, focus on metrics that indicate how well a company can expand its operations and increase its revenue over time. I also use it to get an idea of the predictability of a company.

Did revenue and Earnings per share (EPS) grow over the past several years? Is the grow stable or not? This suggests that the company can attract more customers or sell more products/services, a positive sign of business expansion. EPS growth indicates that the company is not only growing its revenue but also effectively managing its costs, leading to improved profitability.

Consider the company's plans for entering new markets or launching new products. Companies with credible and ambitious expansion plans often have better growth prospects.

Investors should prioritize companies with a track record of sustainable growth and realistic plans for future expansion. High growth rates can lead to significant returns, but it's essential to ensure you don’t overpay for the stock and the growth is sustainable and not driven by one-time events.

Profitability

Profitability is the measure of a company's ability to generate profit from its operations. Evaluating profitability involves examining various financial metrics that provide insight into how efficiently a company converts revenue into profit.

Return on Equity (ROE) is the best measure of management effectiveness. ROE measures the return generated on shareholders' equity. A higher ROE indicates that the company is effectively using investors' funds to generate profits. This metric is particularly useful for comparing companies within the same industry.

Net Profit Margin: This ratio measures the percentage of revenue that remains as profit after all expenses are deducted. A higher net profit margin indicates a more profitable company. Compare this margin to industry and historical averages to gauge relative performance.

Operating Margin: This metric shows the percentage of revenue left after covering operating expenses, excluding interest and taxes. A strong operating margin reflects efficient management and control over operational costs.

Profitability is crucial because it indicates the company's ability to generate cash flow, sustain operations, and potentially pay dividends to shareholders. Companies with robust profitability metrics are typically better positioned to weather economic downturns and invest in future growth opportunities.

Simplified Valuation Process

Valuation is figuring out what an investment is really worth. Top investors like Warren Buffett believe that the price of a stock doesn't always match its true value. Benjamin Graham, known as the father of value investing, taught us to buy stocks for less than their intrinsic value to reduce risk. This idea is called the "margin of safety."

To avoid risky bets and market bubbles, it's crucial to know a stock's true value. Unlike most analysts who use just one method, I've created a toolkit of different valuation methods to get an accurate picture of a company's worth. This approach ensures that we choose the best method for each type of business.

Here's how I do it simply:

1. Key Metrics: I use the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, Price-to-Sales (P/S) ratio, and Discounted Cash Flow (DCF) analysis to estimate a stock's fair value.

2. Comparisons: I compare these metrics with industry peers and historical averages to understand relative value.

3. Visual Valuation Summary: This quick visual tool helps us see if a stock is cheap or expensive without needing an exact number.

This dynamic and straightforward approach helps us make smarter investment decisions by focusing on true value, not just price.

4. Making the Decision: Buy, Hold, or Sell

Armed with a comprehensive analysis, you can now decide whether to buy, hold, or sell a stock. This decision should be based on the stock's fair value compared to the market price, your confidence in the company's future prospects, and your overall investment strategy. Remember, discipline and patience are key. Avoid the temptation to react to short-term market fluctuations and stay focused on long-term goals.

5. Rechecking the Story Every Few Months

Investing is not a set-it-and-forget-it endeavor. Regularly re-evaluate your investments every few months to ensure they still align with your expectations and the initial investment thesis. Monitor any changes in the company's fundamentals, industry dynamics, or broader economic conditions that might impact your investment.

Buffett's Wisdom from the Last Annual Meeting

At the latest Berkshire Hathaway annual meeting, Warren Buffett reiterated the importance of patience and discipline in investing. He emphasized that successful investing is not about predicting market movements but about understanding businesses and investing in those with strong fundamentals and favorable long-term prospects. Buffett's insights remind us that sticking to a sound investment process can lead to substantial rewards over time.

Stay tuned for our next edition, where we'll delve deeper into valuation techniques and share more insights from top investors. Happy investing!

Best regards,

Jasper Bronkhorst

Disclaimer: The information provided in this newsletter is for educational purposes only and does not constitute financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.