Warren Buffett Stock in Focus: Ally Financial Inc.

Ally Financial is trading at a 26% discount of what Warren Buffett paid in 2022.

In the ‘In focus’ series I share my analysis of value stocks and ETF’s. These are stocks which have low valuations, high dividend and/or are bought by top investors.

Warren Buffett’s Berkshire Hathaway increased shares in online banking company Ally Financial by 234.5% in Q2 2022. Since then share price dropped by -26% (stockcircle.com). Why does Buffett think Ally Financial is a good investment?

Highlights:

Balance sheets transformation has led to much higher net interest margin (NIM)

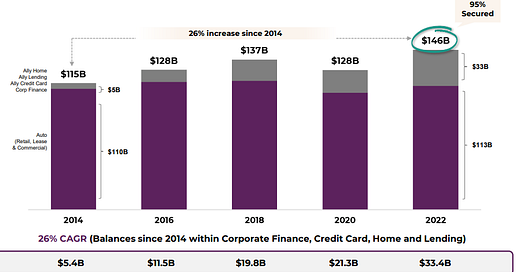

New business is growing fast (CAGR 26%)

Rapidly rising rates and liability sensitive balance sheet creating near term NIM compression

Shares outstanding declined 38% from 2016

Business Overview

Ally Financial Inc. (NYSE: ALLY) is a financial services company with a large all-digital bank and an industry-leading auto financing business. Ally Financial was founded in 1919 and went public in 2014. The company has 11 mln customers, 11,700 employees and $192B in assets.

Ally is an all digital online bank industry leader with 2.7m deposit customers. It is uses the deposits primarily for auto loans. Ally makes money when interest rates on loans are higher than rates paid on deposits and financing. It offers auto financing and insurance through more than 22,000 dealers nationwide. The company is diversifying in mortgages, credit cards and corporate finance.

Ally Financial is trading at 31.05 USD and has a market capitalization of 9,29 mld. EPS was in 2022 $ 6.06. PE ratio is 5.15 and dividend return is 3.86% (Dividend 2022: $ 1.20). The stock price decreased -37% last year.

Competitive Advantages & Market position

The company was founded in 1919 by General Motors (GM) as the General Motors Acceptance Corporation (GMAC) to provide financing to automotive customers. In 2009 the company was rebranded as Ally. And the company is now one of the leading auto finance companies in the US with 3.9M auto customers. Ally is financing this activities with an all digital deposit bank with $152B in deposits.

Quality and Growth

Since 2014 the number of customers has grown from 7M to 11M. The number of Ally Bank Customers is growing the fastest from 0.9 million to 4 million by the end of 2022.

Auto (Retail, Lease & Commercial) is steady but new activities are growing fast at a rate of 26% per year (CAGR).

Net income attributable to common shareholders was $1.6 billion in 2022, compared to $3.0 billion in 2021, as higher provision for credit losses, higher noninterest expense and lower other revenue outweighed higher net interest income. Provision for credit losses increased $1.2 billion over the prior year, due to higher net charge offs as credit normalizes off historic lows as well as reserve releases in the prior year. This resulted in an EPS of $6.06 in 2022 compared to $8.61 in 2021.

Net interest margin is growing due to a transformation of the balance sheet. In 2014 41% was financed by deposits. In 2022 88%. This leads to a higher net interest margin. The yield on deposits was 2.53% and unsecured debt 5.12%.

In 2014 net interest margin was 2,54%, in 2022 3,88%. Ally expects a Net Interest Margin of 3.75% - 4.00% in 2024.

Shares outstanding declined 38% from 2016 and Ally raised dividend.

Auto loans are very cyclical so short prospects are not so good. Long term perspectives are promising with a growing customer base, diversification and a higher expected margin.

Valuation

PE ratio: 5.15

Dividend yield: 3,86%

Ally Financial is trading at a price of $31.05 with PE ratio of 5.15X compared to an average PE ratio of the last 5 years of 7,8, with a range of 4.6 to 11.6.

Based on historical PE valuation $47 would be a fair price, with a range of $27.88 tot $70.30.

Dividend yield is 3,86% with a pay out ratio of 20%. This is very low but Ally is buying shares outstanding which are decreasing fast.

The Financial Consumer Loans industry's average P/E is 9.8X and a dividend return of 1.15% (https://www.macrotrends.net/stocks/sector/13/finance). Major Regional banks have an average PE of 10.92 and a dividend return of 3.32%. Historical valuations of banks and loans companies have a PE range of 8 to 12.

Capital One is a main competitor which is trading at an PE of 6,21 and offers a dividend returns of 2.16%.

8 out of 21 stock analysts offer a Buy recommendation. The average analyst price target is $ 35, but ranges from $21 to $51 (https://money.cnn.com/).

Based on historical valuations and competitors my fair value is $48 tot $60 with a margin of safety of 35% (Margin of Safety = (Intrinsic Value Per Share – Stock Price) / Intrinsic Value Per Share.).

I am much more optimistic than the average analyst and in line with Buffett.

Final Thoughts

Warren Buffett invests in great companies for a reasonable price. I agree with Buffett that Ally is a good company and quite cheap. I don’t have Ally stocks, but I am planning planning to buy after I published this post.

Ally Financial has good growth prospects for the longer term. Financing with deposits is cheaper than other finance options and offers a competitive advantage to auto loan competitors.

But rising rates creating near term net interest margin compression. Ally is still very dependent on auto financing which is cyclical and recession can have a big impact on the short term. For me Ally would be a long term investment.