Dive into Dividends: Exploring the 9.6% Yield of This Dividend King

Stock Analysis & Valuation of Highest Yielding Dividend King

Dear investor,

Today, we're taking a closer look at Leggett & Platt. With an impressive dividend yield of 9.6% and an extraordinary track record of increasing dividends for 53 consecutive years, Leggett & Platt has earned the prestigious title of Dividend King.

Let's explore.

Leggett & Platt is a diversified manufacturer that designs and produces a wide range of engineered components and products for bedding, automotive, aerospace, and furniture markets, offering innovative solutions such as bedding support systems, automotive seating components, and adjustable beds. With a focus on quality and innovation, Leggett & Platt continues to be a leading provider of engineered products globally.

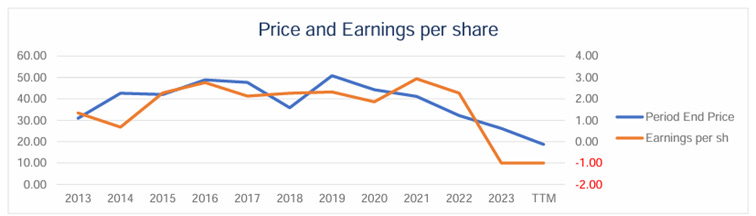

Dividends on the company's common stock have been consistently distributed every year since 1939. However, in 2023, Leggett & Platt experienced its first loss since 2007, impacting its share price, but management anticipates a return to profitability in the coming year.

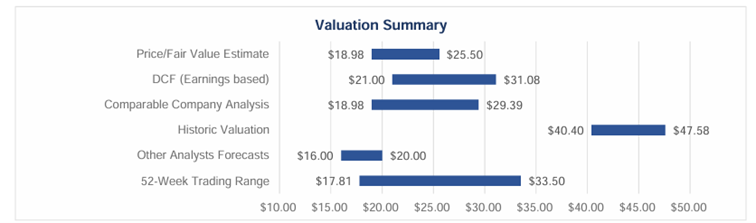

Our investment model suggests that Leggett & Platt's stock is undervalued across various valuation methods. For instance, its current valuation stands at less than half of its historical averages. Our fair value estimate of $25.50 suggests a Margin of Safety of 26%.

At our investment firm, we follow a strategy inspired by legendary investors like Warren Buffett and Peter Lynch. We focus on identifying undervalued companies in the market—those whose true worth isn't fully recognized. This approach involves utilizing various valuation techniques, such as discounted cash flows and comparative analysis within the industry.

Reflecting on past successes, some of my best investments were made during the Covid-induced market drop in 2020. Companies like ING, Shell, and ABN Amro delivered substantial returns when stocks were trading at discounted prices. ACM research, a growth company acquired with a price earnings ratio of 12, has yielded a remarkable 208% return thus far.

With our investment model, we aim to find hidden gems—companies whose intrinsic value exceeds their market price. This isn't about luck; it's about making informed decisions that lead to long-term success while sidestepping costly errors.

Our analysis extends beyond number-crunching. We delve deep into a company's financial health, growth prospects, and other crucial factors to paint a comprehensive picture for our investors.

In each report, we provide insights on whether a company's stock is undervalued, fairly priced, or overvalued. These assessments stem from our robust investment model, bolstered by expert analysis and some AI evaluations.

In this edition, we put Leggett & Platt Group PLC under the microscope.

You'll discover in-depth insights within our comprehensive 4-page PDF report, provided exclusively in The Global Value Report, your Substack newsletter.

Download the Leggett & Platt Report for free:

Thank you for joining us on this investment journey.

Kind Regards,

Jasper Bronkhorst MA