The 91 Best Performing Stocks of the last 10 Years

Insights and Analysis from 10-Baggers like Microsoft and Nvidia

Dear Investor,

Stocks that multiply your investment tenfold is the ultimate pursuit for many investors. These rare treasures, named 10-baggers by Peter Lynch, possess unique characteristics that set them apart from the rest.

For this study, I delved into 8.851 US stocks. After some number crunching, I found that only a tiny fraction of them really stood out, like tenfold standout! In this edition, I share the lessons learned from these top performers. They're packed with valuable insights to help you navigate your investment journey with confidence. Let's dive in together!

Exploring the Tenbagger Concept by Peter Lynch

In investing, the idea of "tenbaggers," a term coined by the famous investor Peter Lynch, is really intriguing. A tenbagger refers to an investment that makes ten times your money.

These rare gems are the Holy Grail for many investors, representing exceptional growth and wealth creation opportunities in the stock market. You only need a few of them to make a career.

Key Characteristics of 10-Baggers

My study has shed some light on the defining traits of 10-bagger stocks. These include being small-cap companies, a strong balance sheet and maintaining a gross margin exceeding 20%. These are the key features of 91 tenbaggers of the last 10 years:

Here's a brief summary of the key characteristics of 10-bagger stocks to enhance chances of future success:

1. Size Matters: Small aggressive new companies offer the greatest potential for large growth. 77% of the stocks were small caps, with a market capitalization of less than 4 billion dollars. But don't focus solely on company size, or you might have missed out on companies like Apple Inc., Microsoft Corporation, Amazon.com Inc., and Meta Platforms Inc..

“Big companies have small moves, small companies have big moves.” ― Peter Lynch, One Up on Wall Street

2. Growth: The backbone of tenbaggers lies in their growth trajectory. Among the stocks analyzed, 63% demonstrated positive EPS growth over a one-year period, while 25% exhibited positive diluted EPS growth over a decade, indicative of youthful enterprises.

Subsequently, these companies boasted an average annual revenue growth of 20% and EPS growth of 14% the last 10 years, underscoring their promising outlook and potential for substantial expansion. Bright prospects are essential and price follows earnings in the end.

3. Valuation plays a crucial role in investment decisions, acting as a safeguard against excessive risk while offering potential for significant upside. Take Microsoft, for instance; a decade ago, it traded at 13 times earnings, but today, that figure has surged to 37 times earnings. Just PE expansion tripled the stock's value. Or can you imagine you could buy Nvidia for 20 times earnings in 2013? The PE ratio is now 67. Maybe interesting for traders. But not for long-term investors seeking to multiply their money.

In terms of valuation metrics, our analysis reveals the following:

36% of stocks had a price-to-earnings (PE) ratio below 25.

63% of stocks had a price-to-book (PB) ratio under 4.

73% of stocks had a price-to-sales (PS) ratio below 4.

47% of stocks had a price-to-free cash flow (P/FCF) ratio under 25.

22% paid dividend

"For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments." - Warren Buffett

Acquiring a rapidly expanding company at a fair price is crucial. Following Peter Lynch's advice, a simple rule is to avoid paying a price-earnings ratio (PE ratio) higher than the growth rate. For instance, if a company grows at 25% annually, ideally, the maximum PE ratio you'd consider is 25, but aiming for less is even better. Additionally, seek out companies with price-to-book (PB) and price-to-sales (PS) ratios below 4 to mitigate risks.

5. Solid Financial Standing: A significant 73% of the stocks boasted a current ratio surpassing 1.5, signaling robust liquidity. Important for fast growing companies. Furthermore, an impressive 86% of the stocks demonstrated a healthy equity-to-assets ratio (>0.25), affirming their solvency and financial stability. To limit your risks look for companies with a robust balance sheet.

6. Profitability: A significant majority, 78%, boasted a gross margin exceeding 20% indicating some kind of competitive advantage, and 65% were profitable. Additionally, 40% had a return on equity (ROE) exceeding 12%.

These traits suggest potential for significant growth in stock value.

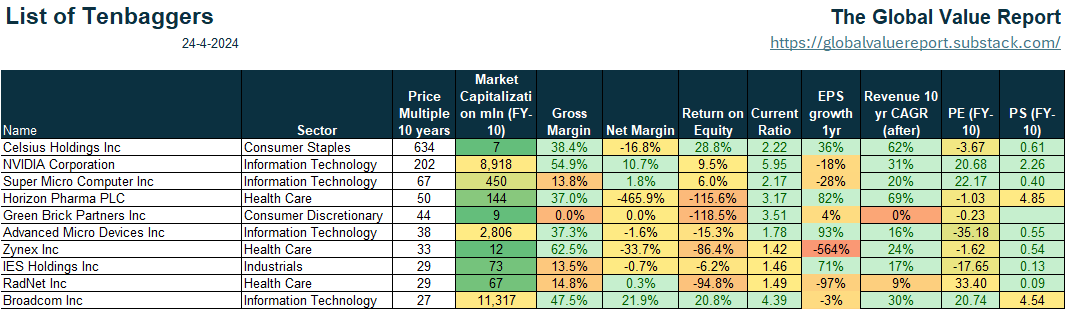

Top 10 List of Tenbaggers

Download the complete list of tenbaggers:

Insights from the Market Landscape

Exploring the landscape of US stocks over the past decade, our analysis has unearthed valuable insights into sectors brimming with potential. Interestingly, compared to Peter Lynch's era, I've observed a notable increase in the number of Information Technology and Health Care tenbaggers. A sustainable competitive advantage is crucial for sustained growth, hence the scarcity of commodity companies like utilities and basic materials on our list. Below is a breakdown of 10-baggers by sector:

Data Insights

Among the 8,851 US stocks in our database, just a small portion have truly blossomed into 10-baggers. I filtered out companies that are no longer traded or lacked a ten-year history, leaving us with 2,952 companies for analysis.

Interestingly, the journey has been diverse:

The Path Forward

With this information, I aim to improve your odds of success and minimize your risks.

In this newsletter, I've highlighted yesterday's tenbaggers. In the next edition, I'll introduce you to high-growth potential stocks from diverse sectors—the potential next tenbaggers. Stay tuned!

Jasper Bronkhorst

About me

Investing has always captivated me. While pursuing my Finance specialization at the University of Amsterdam, I delved into research on the small-cap effect and completed my master's thesis on Tactical Asset Allocation. My professional journey kicked off in 2000 when I embarked on a career in investment research at ING. In the past 8 years, I've had the privilege of sharing my knowledge by teaching Finance and Entrepreneurship to students at the University of Amsterdam. During this time, I created and managed the Investment Management course for 180 students annually, all while running my publishing business on the side.