Welcome to this edition where we explore one of the most transformative concepts in finance: compound interest. It's the cornerstone lesson of my Investment Management course, one I wish I had grasped during my university days.

In the world of investing, understanding and harnessing compound interest can propel you towards long-term wealth. Whether you're a seasoned investor or just beginning your journey, mastering this principle is crucial for reaching your financial aspirations.

Warren Buffett, the legendary investor, once attributed much of his wealth to compound interest, stating, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

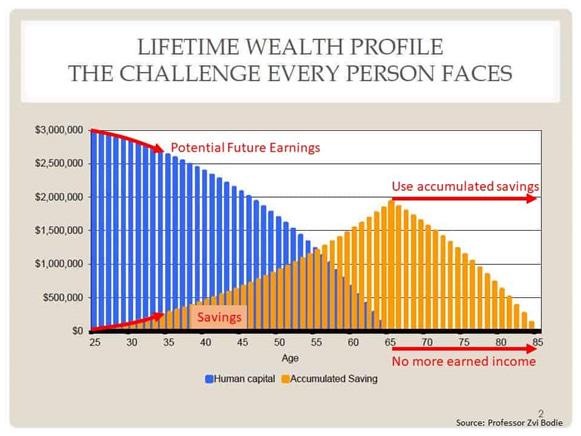

The Investment Challenge

Every saver and investor faces the challenge of accumulating enough capital to meet future needs, such as retirement or funding their children's education. The wealth trajectory for everyone follows a similar path, but the extent of growth depends on contributions, time, and the magic of compound interest working together.

So What is Compound Interest?

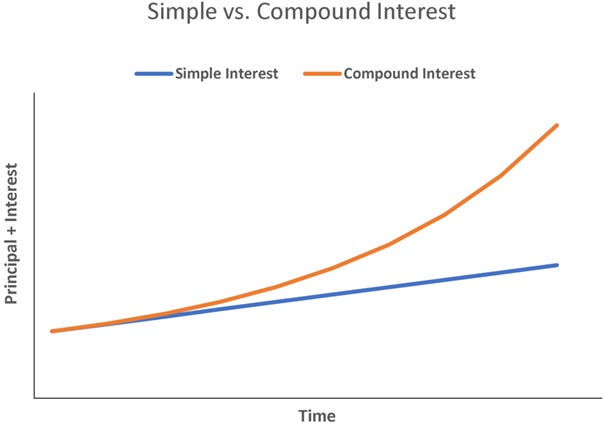

Compound interest is the process where the interest you earn on an investment is reinvested, generating additional earnings over time. Unlike simple interest, which is calculated only on the principal amount, compound interest includes interest on both the principal and the accumulated interest. This creates a snowball effect, allowing your investment to grow exponentially.

Source: https://corporatefinanceinstitute.com/resources/commercial-lending/simple-interest-definition/

Why is Compound Interest So Powerful?

1. Exponential Growth:

The longer you invest, the more your investment grows. Time is your greatest ally.

Example: If you invest $1,000 at an annual interest rate of 8%, in 10 years, your investment would grow to $2,158. In 20 years, it would grow to $4,661.

2. Passive Income:

Your money works for you, generating earnings even when you're not actively managing it.

Over time, this passive income can become a substantial part of your overall wealth.

3. Financial Independence:

Compound interest can help you reach your financial goals faster, whether it's retirement, buying a home, or funding education.

The earlier you start, the more you benefit from the compounding effect.

The Magic of Compound Growth in Action

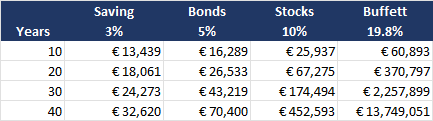

To illustrate the power of compound interest, let’s look at how much $10,000 would be worth after 10, 20, and 30 years at different annual return rates:

This is truly wonderful, isn’t it? The longer you let your investments grow and the higher the return rate, the more exponential the growth becomes. Even modest annual returns can lead to substantial wealth over time, highlighting the critical importance of starting early and being consistent with your investments. This is why I invest most of my money in stocks instead of leaving it in a savings account and why I study great investors to learn how to outperform the market. I share my insights in the Global ValueReport newsletter.

For instance, John Neff managed the Windsor Fund for 31 years, achieving an annual return of 13.7% compared to 10.6% for the S&P 500 index. An initial investment of $10,000 in the Windsor Fund resulted in $564,637, whereas the same investment in the S&P 500 yielded $232,974. Similarly, Berkshire Hathaway has realized an annual growth of 19.8% since 1964.

Compound or Cumulative Growth and the Price You Pay

When you buy a bond, the interest is fixed, resulting in simple interest. Investors, however, often prefer companies that are profitable and can grow their earnings. When a company reinvests part of its earnings, you benefit from cumulative growth.

Many investors believe that as long as they buy stocks in growing companies, the price they pay doesn’t matter. However, this is one of the worst pieces of advice you can follow.

In Mary Buffett's book Buffettology, there is a clear example illustrating this point. If you had invested $100,000 in 1987 in Philip Morris at year low $6.07 per share, the cumulative growth would have been 21.9%, growing your investment to $724,497 by 1997. However, if you had bought the same stocks at $10.36 per share, the cumulative growth would have been only 15.56%, resulting in a value of $424,693 by 1997.

The difference of $299,804 is significant!

How to Maximize the Benefits of Compound Interest

1. Start Early:

The sooner you begin investing, the more time your money has to grow.

Even small amounts invested early can lead to significant growth over time.

2. Consistent Contributions:

Regularly adding to your investments increases the principal and accelerates the compounding process.

Consider setting up automatic contributions to stay disciplined. I invest for example every month the same amount in an US ETF without transaction costs.

3. Reinvest Your Earnings:

Reinvest dividends, interest, and capital gains to maximize growth.

Avoid withdrawing your investment earnings to benefit fully from compounding.

4. Choose the Right Investments:

Select investments with a reasonable rate of return and manageable risk. A higher annual return can have an enormous impact on the wealth you build up.

Diversify your portfolio to balance growth and safety.

Real-Life Example: The Magic of Compound Interest

Consider two investors, Alice and Bob:

Alice: Starts investing $200 per month at age 25 with an 8% annual return. By age 65, Alice will have invested $96,000, and her investment will grow to approximately $622,000.

Bob: Starts investing $200 per month at age 35 with the same return. By age 65, Bob will have invested $72,000, and his investment will grow to approximately $283,000.

The Difference: By starting 10 years earlier, Alice ends up with more than double Bob's final amount, despite only investing $24,000 more.

This is the power of compound interest!

Join Global ValueReport for More Insights

Learn to invest form the best investors. Global ValueReport offers investment research and education. We are dedicated to helping you achieve financial success through smart investing strategies and in-depth analysis. Our premium subscribers get access to exclusive stock picks and detailed investment guides.

In the next edition I share Low price-to-earnings stocks which fit John Neff’s strategy. The 13.7% fund manager of the Windsor Fund.

Warm regards,

Jasper Bronkhorst