Welcome to my newsletter, where I share the most successful strategies for building wealth with you. Inside this edition, you'll discover a carefully curated Small Cap Growth Stock list that align with the criteria established by investment expert Peter Lynch, along with insightful company analysis and stock valuation.

Lynch, renowned for his outstanding 29% annualized return during his tenure managing the Fidelity Magellan Fund, set a high bar for stock selection. To pinpoint the Top Small Cap Growth Stocks, I've leveraged the Russell 2000 index as a guiding framework.

Lynch's investing philosophy for fast growers centers on identifying rapidly growing companies trading at attractive prices. He's a believer in strong fundamentals, and that a company's Price-to-Earnings (P/E) ratio should align with its growth rate.

He proposes a formula that evaluates growth rates against current valuation, incorporating the long-term growth rate, dividend yield, and dividing by the P/E ratio. A ratio below 1 indicates subpar performance, 1.5 is deemed acceptable, while investors ideally aim for a ratio of 2 or higher. For a company growing at a rate of 20% annually, he suggests a maximum of 13 times earnings as an ideal investment threshold.

Small cap growth companies meeting his standards:

Peter Lynch's investing guidelines are quite demanding, making it challenging to find sufficient stocks meeting all his criteria currently. However, many stocks, especially growth stocks, are expensive right now, making it tough to find matches for Lynch's strict standards. Nevertheless, we've identified a few, and investors can still employ his concepts as a roadmap, adjusting them to uncover promising investments.

In addition to quantitative criteria, understanding where and how a company can sustain its rapid growth is essential.

But let's not get too technical - what matters is finding companies with solid growth potential and healthy finances without breaking the bank.

Ad 1. Inmode Ltd valuation is very low compared to the growth rate. InMode is a medical technology company specializing in minimally invasive aesthetic treatments. See my full analysis in de Magic Formula Stocks edition.

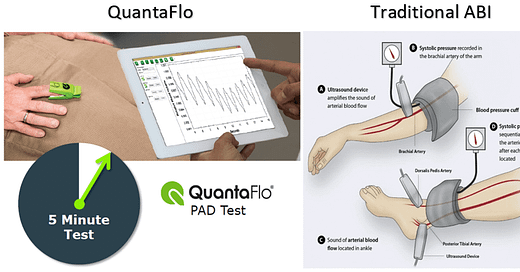

Ad 2. Semler Scientific Inc. demonstrates exceptional profitability metrics and consistent growth, owing to its innovative solution QuantaFlo for early diagnosis of vascular disease Peripheral Arterial Disease (PAD).

However, the company's growth trajectory is uncertain due to its reliance on just three major clients and the impending expiration of its patent in 2027. This renders the stock inherently risky. Nevertheless, Semler is actively pursuing FDA approval for diagnosing other vascular diseases, which could significantly expand its market potential. If Semler secures additional major clients, sales could experience exponential growth. Consider adding it to the watchlist.

Ad 3. Solaria Energía y Medio Ambiente, S.A. emerges as a promising choice, boasting a P/E ratio lower than its growth rate, indicating potential undervaluation. As a leading player in solar photovoltaic energy generation, the company currently operates at a capacity of 1,658 MWh and holds a substantial pipeline of approximately 14,200 megawatts for solar power plants across southern Europe, aiming to achieve 18 GW by 2030. Founded in 2002 and headquartered in Madrid, Spain, Solaria Energía exhibits solid profitability metrics and stable growth, reflecting a dependable business model within the independent power and renewable electricity producers sector. The company prioritizes high environmental, social, and governance (ESG) standards.

Source: https://solariaenergia.com/wp-content/uploads/FY-2023-Presentation.pdf

Notably, in 2023, production surged by 62%, with sales increasing by 37% to €mn. Net profit also saw a notable 19% rise to €107.5mn. Management expresses confidence in achieving a 12% double-digit return target, even in low scenarios, crediting their best-in-class CAPEX strategy for profitability even in low price scenarios. With a PE ratio of 12, Solaria Energía stands as an attractive investment opportunity amidst its high growth trajectory. That’s why I bought Solaria Energía.

Download the research report for free:

Ad 4. Axcelis Technologies Inc exhibits exceptional profitability metrics and consistent growth, driven by innovation and market demand within the semiconductors and semiconductor equipment industry. Strategically positioned in high-growth markets like Electric Vehicles.

Axcelis makes machines that help create computer chips. They specialize in a process called ion implantation, which is important for giving chips specific electrical properties. Axcelis Named to 2022 Fortune Fasted Growing Companies List.

With a robust product portfolio, technical expertise, and established customer relationships, Axcelis stands out as the leader in high-growth specialty device markets. reaffirming its strong market position and growth potential.

Ad 5. XPEL, Inc.: This company demonstrates consistent growth with a P/E ratio lower than its growth rate. It has strong revenue growth and profitability metrics, indicating effective business operations and significant growth potential.

Source: https://www.xpel.com/web-assets/corporate_filings/XPEL_INVESTOR_PRESENTATION.pdf

XPEL, Inc. is a leading provider of automotive paint protection films and automotive window tint. Operating in 12 countries, including the United States (56% of sales), China (10%), Canada (11%), and Europe (12%), XPEL primarily focuses on window film installation through automotive dealership customers.

Looking ahead, XPEL aims to expand its sales team, broaden its non-automotive product portfolio, acquire select installation facilities in key markets, and establish international partnerships for global expansion.

With rapid growth, healthy profit margins, and a robust balance sheet, the company currently trades at 16.8 times earnings (PE ratio). With a long term revenue growth of 29% the company is cheap according to Lynch valuation metrics. However, it's important to note that XPEL's performance is sensitive to market trends.

Ad. 6 ACM Research is a global supplier of advanced wafer processing solutions for the semiconductor and advanced packaging industries. The company offers a wide range of equipment and services designed to help semiconductor manufacturers improve their production processes and yield. ACM Research's products include single-wafer wet cleaning equipment, as well as wafer polishing and planarization equipment. They serve customers in both the semiconductor fabrication and advanced packaging markets, providing solutions to improve the performance and reliability of semiconductor devices. ACM is a fast growing quality company, but not cheap at this moment at a price of $27. I bought at $ 9.50 and keep them.

Ad. 7 Cavco Industries Inc. is a leading provider of manufactured homes, park model RVs, and modular housing solutions, offering a wide range of customizable options and high-quality construction for residential and commercial purposes.

Ad. 9. Jack in the Box exemplifies a typical Peter Lynch investment, being a food franchise with ample growth potential. With approximately 2,200 restaurants spanning 22 states, Jack in the Box stands as one of the nation's largest hamburger chains. Additionally, the acquisition of Del Taco, the second-largest Mexican-American QSR chain in the U.S. with around 600 restaurants across 16 states, has bolstered its market presence. However, the company's weak balance sheet raises concerns, and much of its sales growth can be attributed to the acquisition of Del Taco. Consider adding it to the watchlist.

Ad. 10 Janus International Group Inc. I'm currently in the process of evaluating whether Janus would make a sound investment. Specializing in manufacturing and supplying turn-key solutions for self-storage, commercial, and industrial buildings across North America and globally, Janus offers a diverse range of products including roll-up and swing doors, hallway systems, relocatable storage units, and other solutions. Moreover, they provide facility and door automation, along with access control technologies such as the Noke smart entry system. The company boasts strong profitability and a robust balance sheet.

Janus has executed nine acquisitions since 2016 and holds a pipeline of over 150 potential targets for mergers and acquisitions. Expected annual organic revenue growth ranges between 4% to 6%. As I continue to gather information, stay tuned for further insights into whether Janus International Group Inc. presents a compelling investment opportunity.

While these stocks align with Peter Lynch's investment principles, prudent research and analysis are essential before making investment decisions.

Join us as we navigate the world of investing, uncovering potential opportunities for savvy investors like you!

Jasper Bronkhorst