The Best World ETFs

Find the best World ETFs for both international as US investors. Invest widely diversified in equities around the world with a Global ETF that charges minimal fees.

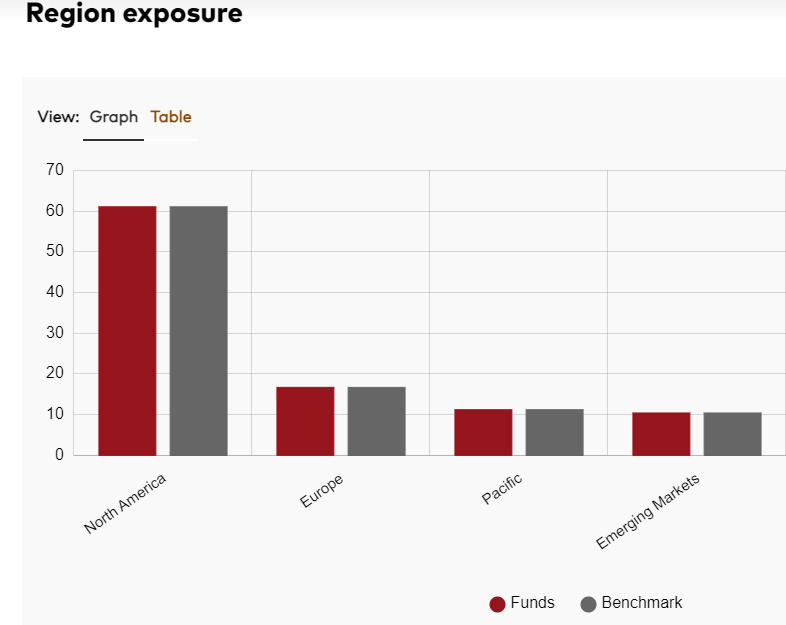

A World ETF is the easiest solution to invest in stocks worldwide. All world ETFs give you exposure to thousands of stocks in the US, Europe and Emerging Markets. Developed world ETF’s have a focus on North America and Europe.

The total expense ratio (TER) of this ETFs tracking stocks worldwide is between 0.05% and 0.40%.

All world ETF’s

Vanguard Total World Stock ETF

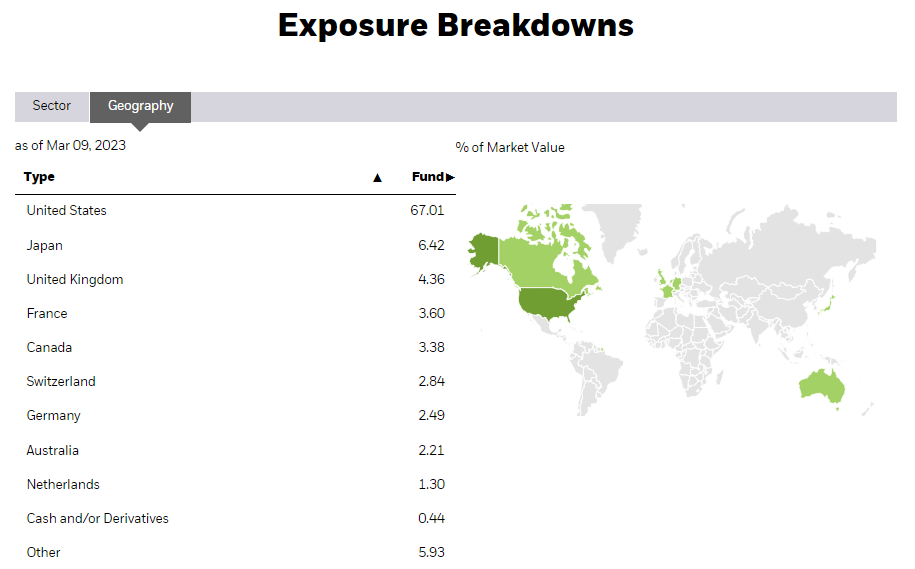

Vanguard Total World Stock ETF seeks to track the performance of the FTSE Global All Cap Index, which covers 98% of both developed and emerging markets with very low costs. The portfolio is composed of equities from the United States (59%), Europe (16%), Japan (6%) and Emerging Markets. VT is available for US investors.

Symbol: NYSE Arca; VT

Positions: 9,523

Expense ratio: 0.07%

P/E ratio: 15.4x

P/B ratio: 2.3x

Annualized returns of the last 10 years was 8.20% per year. Last year return was -7.84%.

iShares MSCI ACWI ETF

iShares MSCI ACWI ETF seeks to track the investment results of an index composed of large and mid-capitalization developed and emerging market equities. iShares MSCI ACWI ETF is traded both in de US as Europe. Expense ratio is lower for European investors and dividends are reinvested.

Code: IE00B6R52259

Positions: 2,318

Expense ratio: 0.32% (US investors), 0,20% (European investors)

P/E ratio: 16.1x

Dividend return: 1.74%

P/B ratio: 2.54

Vanguard FTSE All-World UCITS ETF

Vanguard FTSE All-World UCITS ETF is open for European investors. The Index is comprised of large and mid-sized company stocks in developed and emerging markets. This fund is available as Distributing (VWRL) and Accumulating (VWCE).

Positions: 3,733

Expense ratio: 0.22%

P/E ratio: 16x

P/B ratio: 2.5x

Register countries; Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, United Kingdom, Hong Kong, Ireland, Italy, Liechtenstein, Luxembourg, Mexico, Netherlands, Norway, Portugal, Sweden and Singapore.

Alternative:

SPDR MSCI ACWI UCITS ETF, TER 0,40%

Developed world ETF’s

SPDR MSCI World UCITS ETF

SPDR MSCI World UCITS ETF is traded in Germany, London, Amsterdam, Swiss Exchange and Italy.

Symbol: ISIN IE00BFY0GT14, Ticker SPPW

Positions: 1,491

Expense ratio: 0.12%

P/E ratio: 15,64

Dividend return: 2.08%

P/B ratio: 2.6

Vanguard FTSE Developed Markets ETF

Vanguard FTSE Developed Markets ETF (VEA) is comprised of developed countries ex. US. Available for US investors.

For international investors Vanguard FTSE Developed World UCITS ETF - (USD) Distributing (VEVE) comprised of developed countries with US included.

Symbol: VEA.IV / VEVE

Positions: 4,090 / 2.196

Expense ratio: 0.05% / 0.12%

P/E ratio: 12.6x /16.7x

P/B ratio: 1.6x / 2.5x

iShares MSCI World ETF

The iShares MSCI World ETF seeks to track the investment results of an index composed of developed market equities. iShares Core MSCI World UCITS ETF is open for European investors (TER, 0.2%, IE00B4L5Y983). iShares MSCI World ETF is the largest with USD 43 bln AUM.

Positions: 1,514

Expense ratio: 0.24%

P/E ratio: 17.2

Dividend return: 1.73%

P/B ratio: 2.71

Alternatives:

Lyxor Core MSCI World (DR) UCITS ETF - Acc, TER 0.12%, ISIN LU1781541179, Ticker LCUW

Xtrackers MSCI World UCITS ETF 1D, TER 0,12%, ISIN IE00BK1PV551, Ticker XDWL

HSBC MSCI World UCITS ETF USD, TER 0,15%, ISIN IE00B4X9L533

Disclosure: the author has positions in Vanguard FTSE All-World UCITS ETF.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. All opinions are my own. Not financial advice. Please consult your financial advisor before making any investment decision.